From 1st April 2024, If your Mutual Fund KYC status is not validated, you cannot invest. How to check and validate KYC status to start investing in mutual fund?

As you are all aware completing the KYC is the first step of investing in mutual funds. However, sadly the KYC process in India is still under trial and error mode. Hence, this new issue popping to all mutual fund investors. Let us try to understand the historical point of KYC because of which many investors are facing issues now.

As part of the Prevention of Money-Laundering (Maintenance of Records) Rules, 2005, mutual fund investors were asked to redo the KYC by March 31, 2024, if it was previously done using non-OVD. What do you mean by OVD?

OVD means Officially Valid Documents for KYC purposes. What are the officially valid documents for proof of identity and proof of address? They are – a passport, Driving License, Aadhaar, Voter ID, job card issued by NREGA duly signed by an officer of the State Government, the letter issued by the National Population Register containing details of name and address, and any other document as notified by the Central Government in consultation with the Regulator.

Hence, those who completed their KYC earlier by providing the valid OVD documents, then they all must redo the KYC based on the status available against their PAN.

How to check your Mutual Fund KYC Status Online?

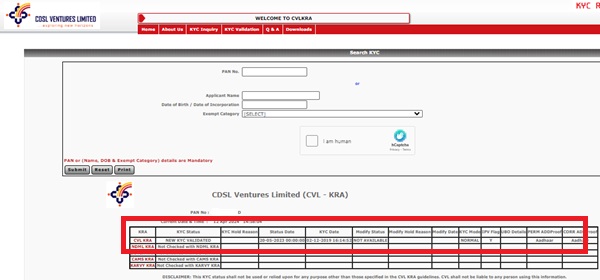

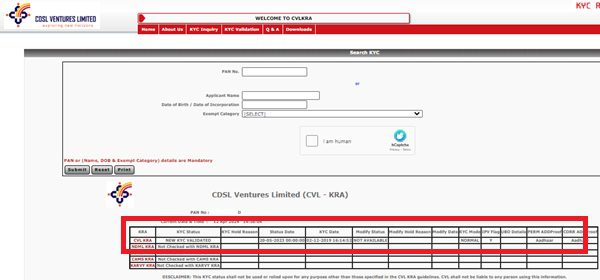

The simple way to do this is by visiting the CVL KRA website. Click on the tab called “KYC Inquiry”. Provide your PAN number, validate that you are a human, and then click on the “Submit” tab. The status may look like below.

What types of KYC status will you find and what is the meaning of those?

There are four types of status one can find when they check KYC status online. Let me explain one by one of what is the meaning of these statuses.

# KYC Validated –

It means OVD data is validated with the issuing authority, i.e. UIDAI, PAN-Aadhaar linking done, Email and/or Mobile validated.

# KYC Registered –

It means where Aadhaar OVD data could not be validated with the issuing authority i.e. UIDAI, PAN-Aadhaar linking seeded, and Email and/or Mobile is validated.

# KYC On Hold –

It means that the proof cannot be validated with the issuing authority and Email and/or Mobile is not validated.

# On Hold –

Irrespective of valid or non-valid OVDs, if invalid contact details are available, then you will get this message.

What type of restrictions will be made from April 01, 2024, based on your KYC status?

There are around 8 reasons and effects that I will explain to you one by one in detail.

1) Type of OVD used – Aadhaar – KYC Validated

In this case, the status will show you as “KYC Validated”. There will be no change for the investors. Investors can continue to transact with the existing funds and also can invest in new funds with new folios.

2) Type of OVD used – Physical Aadhaar – KYC Registered

In this case, the status will show you as “KYC Registered”. As I mentioned above, it means Aadhaar is not verified but your contact details are verified. In such a situation, if you are a new investor with a new AMC, you should be requested to submit a fresh Aadhaar copy where the QR code is scannable and validated.

There will not be any change if all financial transactions with the existing mutual funds where investor PAN is found to be available and KYC status is Registered / Validated as of 31st March 2024.

3) Non Aadhaar OVD (But used allowed OVDs) – KYC Registered

In this case, the proof cannot be validated with the issuing authority and Email and/or Mobile is validated. Hence, the status will show you as “KYC Registered”.

There will not be any change if all financial transactions with the existing mutual funds where investor PAN is found to be available and KYC status is Registered / Validated as of 31st March 2024.

If you wish to invest in any new mutual funds with new folio, then you should be requested to complete KYC process using Aadhaar as OVD through Online mode and got successfully validated, then there will not be any requirements to do re-KYC.

4) Non Aadhaar OVD (But used allowed OVDs) – KYC On Hold

In this case, the proof cannot be validated with the issuing authority and Email and/or Mobile is not validated.

Investor will be required to submit valid Email and/or Mobile with the existing Intermediary or through any other Intermediary and to be uploaded as KYC modification request with the concerned KRA.

Investor should be requested to complete KYC process using Aadhaar as OVD through Online mode and got successfully validated, then there will not be any requirements to do re-KYC

5) Deemed OVDs (other than Allowed OVDs) – KYC Registered

In this case, the proof cannot be validated with the issuing authority and Email and/or Mobile is validated.

There will not be any change if all financial transactions with the existing mutual funds where investor PAN is found to be available and KYC status is Registered / Validated as of 31st March 2024.

If you wish to invest in any new mutual funds with new folio, then you should be requested to complete KYC process using Aadhaar as OVD or allowed OVDs through Online mode and got successfully validated, then there will not be any requirements to do re-KYC.

6) 5) Deemed OVDs (other than Allowed OVDs) – KYC On Hold

In this case, the proof cannot be validated with the issuing authority and Email and/or Mobile is not validated.

In such situation, all financial and select non-financial transactions will be restricted unless remediated documents are submitted. Investor will be required to submit valid Email and/or Mobile or PAN-Aadhaar link to be made and confirmation to be submitted to the existing as well as with new mutual funds and uploaded as KYC modification request with the concerned KRA.

Investor should be requested to complete KYC process using Aadhaar as OVD through Online mode and got successfully validated, then there will not be any requirements.

7) Non-OVDs (other than listed above) – On Hold

In such situation, all financial and select non-financial transactions will be restricted unless remediated documents are submitted. Investor will be required to submit valid Email and/or Mobile or PAN-Aadhaar link to be made and confirmation to be submitted to the existing as well as with new mutual funds and uploaded as KYC modification request with the concerned KRA.

Investor should be requested to complete KYC process using Aadhaar as OVD through Online mode and got successfully validated, then there will not be any requirements.

8) Invalid contact details [Email and / or Mobile] irrespective of OVDs submitted – On Hold

All financial and select non-financial transactions will be restricted unless remediated documents are submitted. Investor will have to provide new contact details before transacting with existing MF.

Investor should be requested to complete KYC process using Aadhaar as OVD through Online mode and got successfully validated, then there will not be any requirements.

Conclusion –

If KYC status is other than KYC Validated, investor has to submit the KYC documents again.

If the KYC status is On-Hold, as per the current process, both financial transactions and select non financial transaction will be restricted until the KYC status is remediated by submission of modification request with respective KRA through any of the intermediary to become KYC Validated/Registered.

Systematic transactions registered in the existing folios will continue to be triggered. As per the existing process, further triggers will be restricted in the folios where KYC status is other than Validated / Registered, i.e., KYC On-Hold.

In conclusion, it is better first check the KYC status. If your status is not mentioned as “Validated”, then in my view, better to submit Aadhaar document and update your contact details (check if there is any change) by doing the re-KYC either online on the website of a few fund houses, like Quantum or UTI. Like in re-KYC done offline mode, the updated KYC will reflect in your MF investments across all AMCs. In both cases, make sure that your PAN and Aadhar are linked. Otherwise, you will face a problem completing the process.