Every day, you’re inundated with information. From social media to texts, phone calls, emails, and news alerts—it’s incredible how much information we process regularly. So, when it comes to handling your finances, it’s natural to think that the information you hear repeatedly is the best advice to follow. After all, plenty of people are making a living sharing financial advice online (we refer to them as “influencers”). Shouldn’t you listen to what they have to say?

Well, no… not necessarily.

Here are five pieces of popular personal finance advice we can almost guarantee you’ve heard before and why you shouldn’t necessarily take it.�

Lesson #1: “Skipping Your Daily Latte Will Make You a Millionaire”

This famous personal finance “lesson” seems to be a favorite for Baby Boomers who see younger people enjoying their little “luxuries,” whether it’s a daily trip to Starbucks or a plate of avocado toast. And frankly, aside from bad advice, it’s condescending.

Sweating the small stuff isn’t always the correct answer, especially if you’remaking meaningful purchases that bring you joy. Let’s put it in perspective: spending $5 on a latte five days a week would equate to about $1,300 a year. Not enough for a down payment on a house or a new car.

Let’s take it a step further and look at what investing that $5/day (or $1,300 a year) would look like instead of spending it on a latte.

For this example, we’ll assume an annual rate of return of 7%. Say you aim to put a down payment on your dream house in three years. ($108.33 monthly for three years, giving you $4,326 in returns).�

Unfortunately, that won’t be enough to cover the down payment on your dream house. While down payments will vary greatly, the average median for a down payment on a house in America is $34,248 — this leaves you a bit short. Of course, if you live in a city with a higher cost of living, the median cost rises. Take Washington, D.C., for example, which boasts an average median down payment of $100,800.2 �

Instead of feeling guilty about enjoying your daily coffee, focus on reducing your most significant expenses, such as housing and transportation. If you’re determined to purchase a new home or reach another significant financial milestone, it will take more considerable lifestyle changes than skipping coffee to meet your goals. Consider getting a roommate to split housing costs or purchase a used car with cash instead of financing a brand-new one.

Pinching pennies with your discretionary spending isn’t sustainable and can harm your overall well-being and sense of fulfillment. If something makes you happy and you can afford it without blowing the budget, go for it.�

Client Story

We had a client saving up for a down payment on a home. After trying to cut out the “small stuff” for a while, she moved in with her family and virtually eliminated her housing costs. This allowed her to save for her first home and pay her debt more aggressively. She found that this life change made a much more significant impact on her ability to reach her savings goal than trying to cut back on her discretionary spending. She bought a house 18 months later instead of a decade.

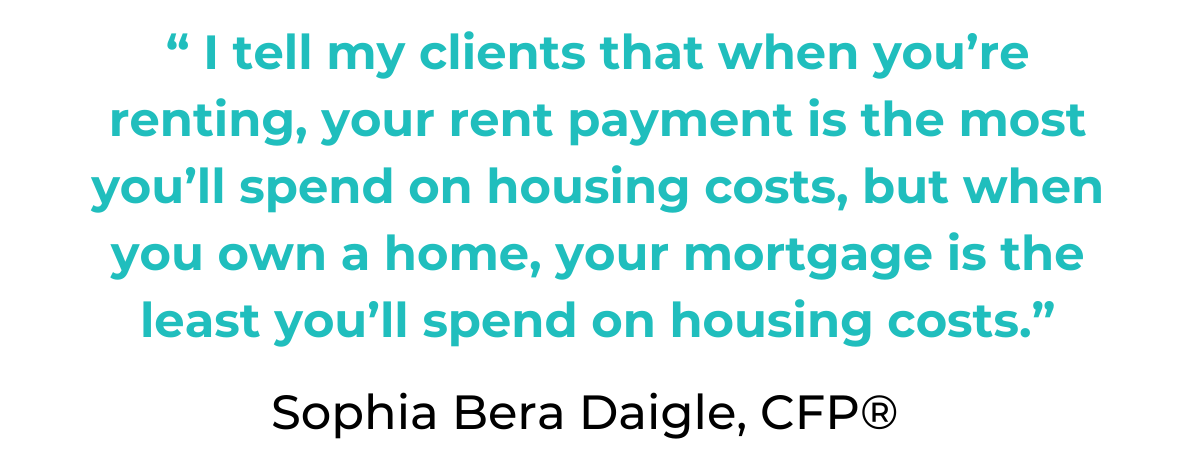

Lesson #2: “Owning a Home Is Always Better Than Renting”

Homeownership is often looked at with rose-colored glasses. We’re told time and time again that success means a white picket fence and a (large) mortgage. But we urge you tochallenge the notion of homeownership and recognize that it is, in fact, not always the superior choice.

The big hangup people have with renting is that you’re giving money to a landlord, essentially helping somebody else pay their mortgage and build equity in their home. But before writing it off completely, consider the benefits of renting (and there are many!).�

When you don’t own a piece of property, you’re not the one responsible when something goes wrong. A pipe bursts, the ceiling leaks, and the tub drain clogs up—not your problem! And house repairs can get expensive, so being able to pass the buck when things go awry is a significant advantage.

When you rent, you aren’t responsible for paying property taxes and don’t have to worry about general maintenance costs such as servicing the HVAC system, repaving the driveway, cleaning the gutters, etc. Unexpected repairs can come up, and these can be costly.�

When you rent, you aren’t responsible for paying property taxes and don’t have to worry about general maintenance costs such as servicing the HVAC system, repaving the driveway, cleaning the gutters, etc. Unexpected repairs can come up, and these can be costly.�

Renting also provides flexibility and mobility, which is vital if there’s a chance you or your partner would have to relocate for work or family suddenly. It is much easier and more affordable to leave a rented space (especially if you’re on a monthly lease) than to sell your house. You don’t have to worry about market conditions or interest rates.

Purchasing a home can be a rewarding experience, but it’s worth considering all options before tying your money up in such a significant asset.

The Pros and Cons of Renting

| Pros | Cons |

| ✅ You’re not responsible for property repairs or upkeep. | ❌ You’re not building home equity. |

| ✅ You don’t pay property taxes. | ❌ Your rental rate is likely higher than a mortgage would be. |

| ✅ You don’t need to worry about unexpected costly home repairs. | ❌ Having your rental application approved can be hard, especially in competitive markets.� |

| ✅ You have flexibility and mobility. | ❌ You’re at the mercy of your landlord, meaning you’re subject to rent increases or changes to your lease. |

| ✅ You don’t have to worry about housing market conditions or interest rates. | ❌ Most landlords require substantial upfront deposits (first month’s rent, last month’s rent, security deposit, etc.) |

Client Story

We work with a client who has enough savings to purchase a home but chooses to live in a low-rent apartment with roommates. This decision allows her to save even more money for a larger down payment. As a result, she’s considering buying a duplex that will allow her to earn rental income from the other half, essentially living rent-free while her tenant helps her build equity and grow her net worth.

Lesson #3: “All Debt Is Bad”

If you’re human, there’s an excellent chance you’ll have to take on debt at some point, and that’s okay! Rather than try for the impossible (avoiding all forms of debt ever), focus instead on distinguishing between “good debt” and “bad debt.”

Taking on good debt means using a strategic borrowing strategy to help pursue wealth-building opportunities, such as home buying orhigher education. Bad debt, on the other hand, is typically high-interest debt that doesn’t serve your more significant goals or long-term needs. Bad debt includes consumer debt, like credit card debt and personal loans.

No matter what type of debt you accrue, you still owe it to your financial well-being to weigh your options and manage it responsibly. For example, the timing of taking on a loan can make a huge difference in how it plays into your greater financial picture.

| 30-Year Fixed-Rate Mortgage Trends Over Time | |

| Year | Average 30-Year Rate |

| 2019 | 3.94% |

| 2020 | 3.10% |

| 2021 | 2.96% |

| 2022 | 5.34% |

| 2023 | 6.81% |

Sourced from:Mortgage Rates Chart | Historical and Current Rate Trends

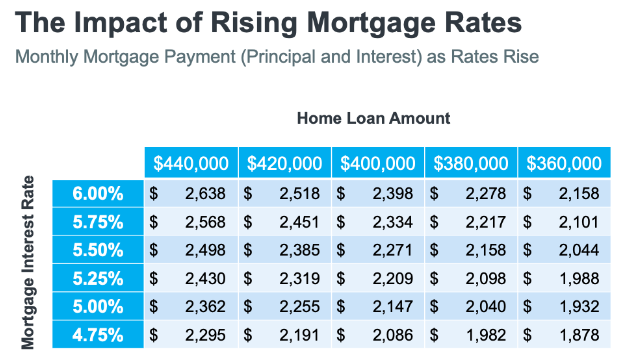

In 2020 or 2021, you may have taken advantage of a 3% mortgage rate when you bought a home or refinanced your previous mortgage. But by the end of 2023, interest rates rose significantly, making buyers more cautious about taking on new debt (especially auto loans or home equity lines of credit).

Sourced from:How to Approach Rising Mortgage Rates as a Buyer | Ward Realty Services

All debt is not bad, but it’s important to use debt strategically. Instead of financing a car loan, like you may have done a few years ago, it might be time to dip into savings to pay cash for a used vehicle or save up for the home renovation you’ve been dreaming about.

If you have credit card debt at a 25% interest rate, now may be time to do a balance transfer to a 0% credit card so that you’re not paying hundreds of dollars in interest every month. You can get out of debt much faster by being aggressive about your monthly payments. You move debt from “bad debt” to “good debt” by being strategic about the interest rate and debt repayment strategy.

Lesson #4: “Everyone Needs Life Insurance”

There are many life insurance policies, but two common ones are term and whole. Term life insurance is active for a set amount of time (think 10, 20, 30-year periods). Once the term has expired, the coverage ends.

Whole life insurance is an insurance policy that lasts your lifetime and has no expiration date. Some whole-life policies accrue a cash balance and act as an investment vehicle.

Insurance brokers sometimes push whole life insurance policies heavily because of their large commissions and kickbacks. Because of the incentive to sell, people are saddled with expensive monthly premiums for a policy that doesn’t fit their lifestyle or needs.

When you’re in your 20s, for example, you may not have dependents or significant assets that require such robust coverage. Instead, you’re better off investing the money you would pay on premiums in aRoth IRA (as an example).

When used strategically, however, term life insurance can offer cost-effective coverage for your family. Use term policies to help protect your family’s financial well-being during high-cost years. For example, in your 30s and 40s, you may have a large mortgage and a spouse or children who depend on your income. A term life policy can offer critical financial protection and cover costs like childcare, college, retirement, or mortgage payments.

Client Story

Sometimes, a client comes to us with a whole life insurance policy. In many instances, it’s one of their most significant monthly expenses. We often help them cash out their policy and redirect the cash value and those monthly premium payments toward paying down debt, building up savings, or funding other financial goals. In addition, we help them find a much more affordable term life insurance policy that offers more protection for a time when they need it most.�

Lesson #5: “Saving More Money Is Always the Solution”

It’s great to bea savvy saver, but there are limitations to putting too much focus on your savings strategy. Letting money sit in a checking account accruing virtually no interest isn’t making your money work for you.

Start small by opening a high-yield savings account. Even earning 4% on your money can be a vast improvement! Moving $10,000 from your checking account, earning nothing in interest, to your savings account, earning 4%, you’d have made over $400 throughout the year!

Checking vs. High-Yield Savings Account: $10,000 in Savings over ten years�

For demonstrative purposes, assume interest rates stay the same over the next ten years, no additional funds are added to the account, and the interest compounds annually.3 �

| Year | Checking Account (0.07%)� | HYSA (4% interest) |

| 0 | $10,000 | $10,000 |

| 1 | $10,007 | $10,400 |

| 2 | $10,014 | $10,816 |

| 3 | $10,021 | $11,248 |

| 4 | $10,028 | $11,698 |

| 5 | $10,035 | $12,166 |

| 6 | $10,042 | $12,653 |

| 7 | $10,049 | $13,159 |

| 8 | $10,056 | $13,685 |

| 9 | $10,063 | $14,233 |

| 10 | $10,070 | $14,802 |

| Total Interest Earned | $70 | $4,802 |

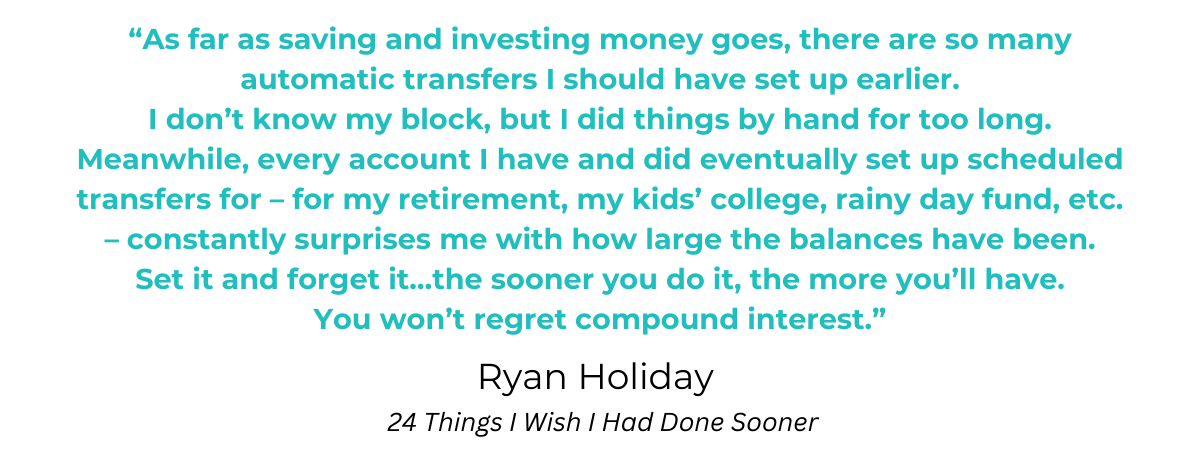

The next step to building wealth isinvesting your money. The chance that high-yield savings accounts will still be paying 4% interest a few years from now is low. Therefore, if you don’t invest your money, you may lose money to inflation. This is why investing over the long term is so important.

Opening a brokerage account and setting up a recurring deposit into low-cost index ETFs or mutual funds will significantly impact your ability to grow your net worth long-term. You are allowing your money to grow and (hopefully) outpace inflation (which has seen record highs in recent years). Otherwise, all that cash starts to erode from the effects of inflation, and your purchasing power decreases over time.

And when we say investing, we’re not only talking about the markets. One of the best investments you can make is in yourself, whether pursuing a new passion, expanding your skillset, negotiating a higher salary at your new job, learning a new language, or anything else that interests you. Find new ways to make yourself more valuable and explore income-generating opportunities, such as starting a business or side hustle.�

Moving from a saver to an investor provides you the flexibility and opportunity to reach significant financial milestones and exponentially grow your retirement savings.

Debunking Bad Financial Advice

Plenty of people in life and online like to share personal finance advice. But we encourage you to listen and evaluate the information carefully. Personal finance balances enjoying your hard-earned wealth today and being mindful of your future goals.

There’s no one-size-fits-all financial advice that will help you become a millionaire overnight, and you should run far, far away from anyone who promises otherwise. Feel free toreach out if you’re tired of getting financial advice that may (or may not) apply to your specific situation. I’d love to connect!�

Sources:

1How Much Information Does the Human Brain Learn Every Day?

2Average Down Payment On A House In 2024

You might also enjoy reading: