Corporate leaders oversee relationship management on many fronts, including employee engagement and customer satisfaction, and corporate gift-giving is an effective strategy to tackle it. After all, 57% of employees and 52% of consumers are more likely to be loyal to companies that provide gifts.

However, companies must give gifts fairly and responsibly for them to have the desired effect—and that’s where corporate gift-giving laws come in. In this guide, we’ll cover everything you need to know about these policies on presents, including:

Let’s begin by taking a closer look at gift-giving basics!

Corporate Gift-Giving Laws FAQS

What are corporate gift-giving laws?

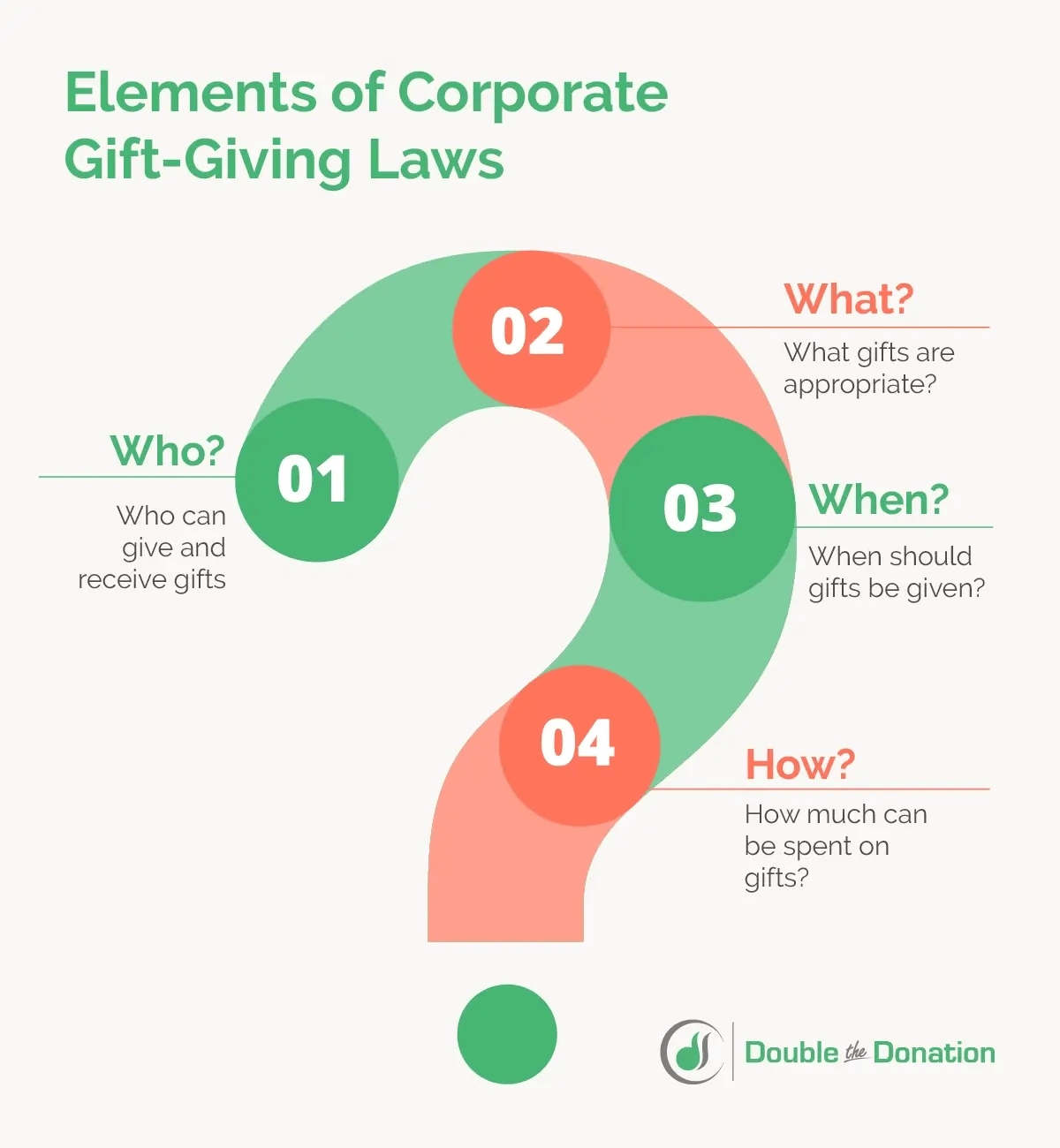

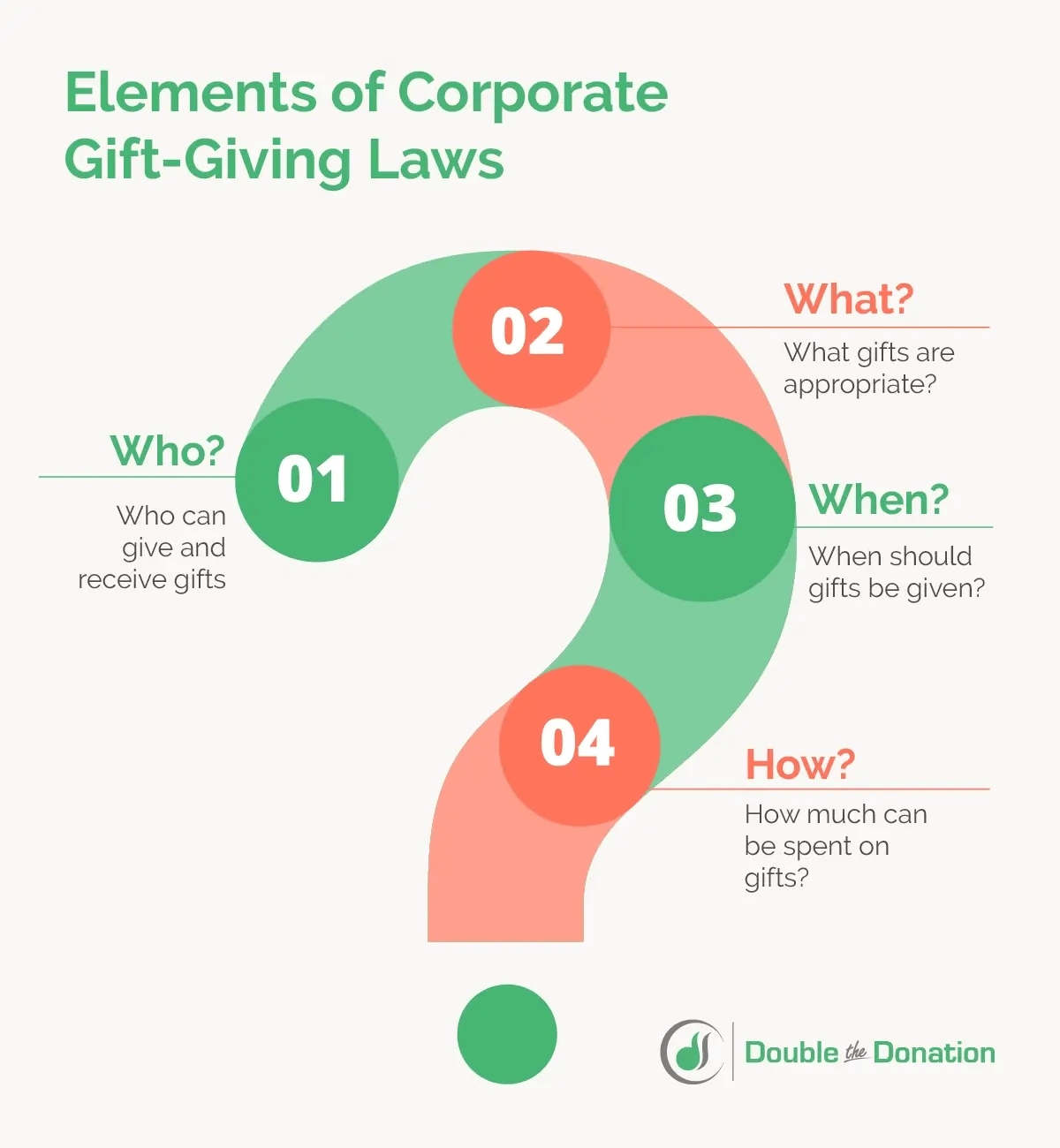

Corporate gift-giving laws are policies created by a company to standardize internal and external gift-giving, helping prevent bribery, favoritism, and other conflicts of interest. These policies generally outline the circumstances in which the company’s employees can give or receive gifts, including:

- Who can give and receive gifts? Corporate gift-giving laws outline gift exchanges between peers, superiors, and clients.

- What gifts are appropriate? Policies concerning corporate gift-giving may define the types of gifts that can be given or received, such as specific tangible items or monetary gifts.

- When should gifts be given? Corporate gift-giving laws should specify how often gifts can be given to monitor the amount of gifts that are sent or received.

- How much can be spent on gifts? A well-planned policy outlines the budget for gift-giving, determining how much can be spent on a gift.

With a policy that lays out these details, your company will be equipped to start exchanging gifts with clients, employees, business partners, and other contacts to strengthen relationships with your professional network. Let’s break this down further by examining the essentials of gift-giving and receiving.

What is an employee gift policy?

Giving employees gifts can have a significant impact on your company’s efforts to recognize, engage, and retain employees. Generosity can also increase productivity, with 81% of employees stating they are more likely to work harder when an employer appreciates their efforts.

This means your company should craft an employee gift policy that outlines how you’ll show appreciation through gifts and under what circumstances. This policy will depend on the following elements:

Tax implications of employee gifts

The IRS states businesses can deduct $25 of the gift value per recipient per tax year. For example, let’s say leadership gives each employee a $35 snack box. $25 of that cost would be tax-deductible for each gift.

To deduct these expenses, your company must have records that include the details of the amount spent and prove the business purpose of the gift. This also applies to gifts given indirectly to an employee, such as to a spouse or family member.

However, some types of gifts, such as gifts that can be considered entertainment, are not tax deductible. For example, if you were to gift clients bottles of wine and take them to an orchestra performance, the wine bottles would be tax deductible but the orchestra tickets would not.

Employee gift reporting

For the sake of accountability and to keep your books in order, determine how your company will report the gifts it gives. This will be an important part of your policy, which not only lays out the gift-giving process but also how you’ll report and track gifts.

Be sure to keep thorough records including:

- The value of the gift

- When the gift was given

- Who the recipient was

- The reason for the gift

Determine who will be in charge of recording employee gifts and where these records should live.

What are corporate gift acceptance policies?

Aside from giving gifts, your company may also receive gifts from clients, customers, or other corporations. To account for this, create a gift acceptance policy that determines which gifts are given and under what circumstances they’re acceptable on behalf of your company.

How to Create Corporate Gift-Giving Laws

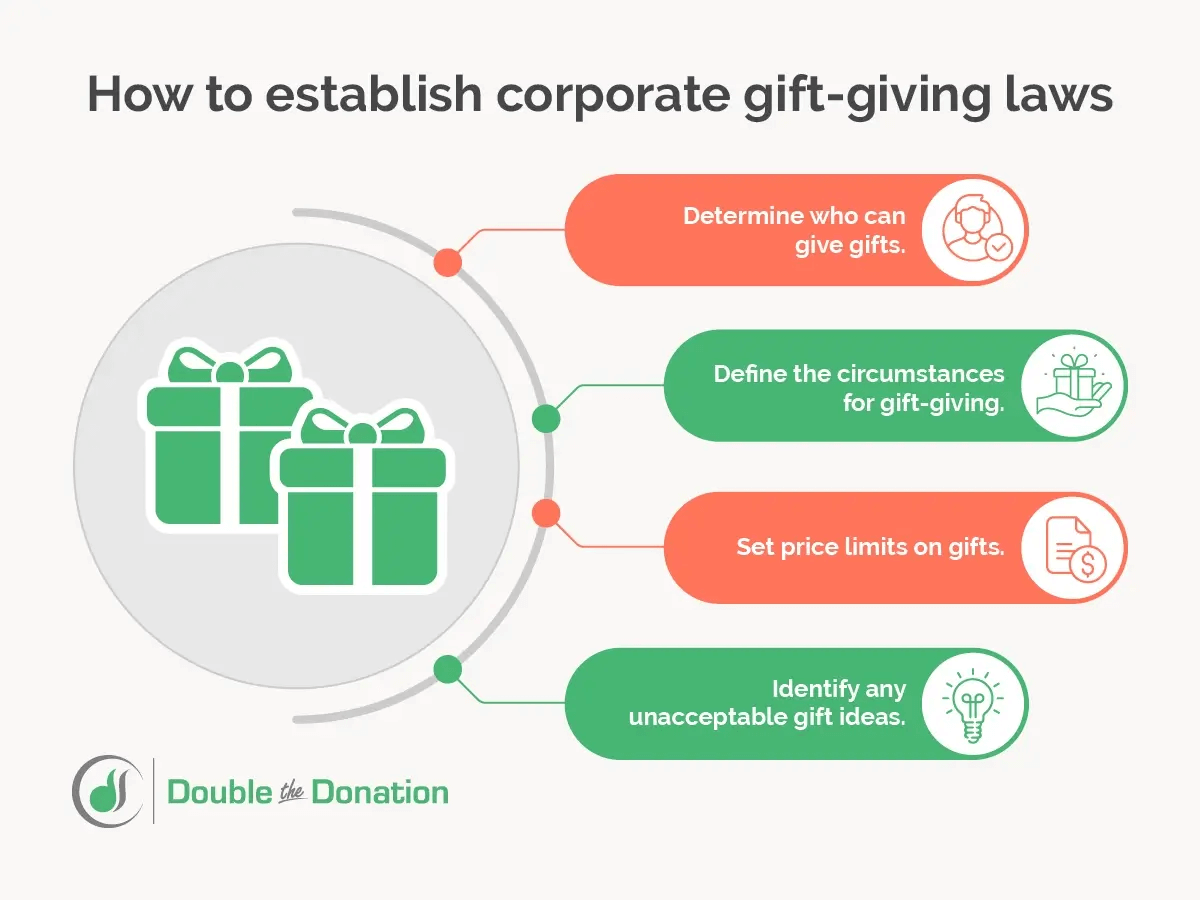

So how do you get started, and what should you include? Create corporate gift-giving laws for your company using the following steps:

- Determine who can give gifts. Decide which members of your company’s leadership have the authority to purchase and give gifts. For example, should managers have the authority to give employee gifts, or should they recommend certain employees for rewards and leave the gift-giving to leadership?

- Define the circumstances for gift-giving. Write out the purpose of gift-giving and under which circumstances gifts are appropriate. For example, if your company seeks to give gifts as part of its employee recognition strategy, you might create a gift-giving timeline based on specific work-related accomplishments or anniversaries.

- Set price limits on gifts. Outline specific price limits in your gift policy. Consider setting price ranges for various gift types and occasions. For example, a work anniversary might warrant a $50 plaque while a retirement gift could be more expensive. Remember your gifts may vary based on availability or the purpose of the gift.

- Identify any unacceptable gift ideas. Provide flexibility for the types of gifts that can be given, but recognize that some gifts should never be given. For example, gifting a pair of jeans with no relevance or branding to your business could be inappropriate and unprofessional. Make a list of specific gift items that shouldn’t be given under any circumstances.

Make provisions for this policy to be adjusted in the future, if necessary. It’s difficult to include everything, and you may encounter a unique situation in the future that calls for you to revisit your policy. To visualize how you might put these key elements together in one, comprehensive policy, let’s go over a template!

Corporate Gift-Giving Policy Template

If you need help getting started, fill in this template with your company’s unique information:

[Company’s name] recognizes gifting as a customary practice and a meaningful way to show appreciation. To avoid perceptions of bribery, favoritism, and other conflicts of interest, this policy will outline the guidelines and acceptable norms for giving and receiving gifts.

-

- Definitions

“Gift” refers to cash, goods, or services of commercial value that are given to an individual for personal benefit without any expected return of payment. - Scope

This policy applies to [list roles that should follow this policy]. At [Company’s name], the following individuals are authorized to give or receive gifts on behalf of the company:

[List individuals allowed to give or receive gifts] - Unacceptable Gifts

The following gifts are unacceptable to be given or received on behalf of [Company’s name]:

Gifts of expensive electronic items, such as mobile phones, laptops, or TVs.

Personal gifts of clothing or jewelry are inappropriate and strictly prohibited.

[List any other unacceptable gifts] - Price Limits

[Company’s name] shall adhere to the following price ranges when giving gifts:

Employee recognition gifts should not exceed [Amount].

Work anniversary gifts for any employee should not exceed [Amount].

Gifts accepted from clients/customers should not exceed [Amount]. - Gift Receipts

After giving or receiving a gift, any employee at [Company’s name] should record the gift by [Process for recording gifts].

- Definitions

Consider also creating a gift refusal letter template that employees or leadership can use to appropriately represent your company in the event they must decline a gift.

Corporate Gift Ideas

Coming up with a list of acceptable gifts can help you further standardize the process of rewarding employees and stewarding customers. Consider the following gift ideas.

Matching gifts

While matched donations aren’t tangible or deliverable via a gift bag, they’re a great way to show employees that your company cares about the same causes they do. Incorporate a matching gift program into your company’s existing philanthropic efforts and add guidelines to your employee handbook or portal so your team knows how to participate.

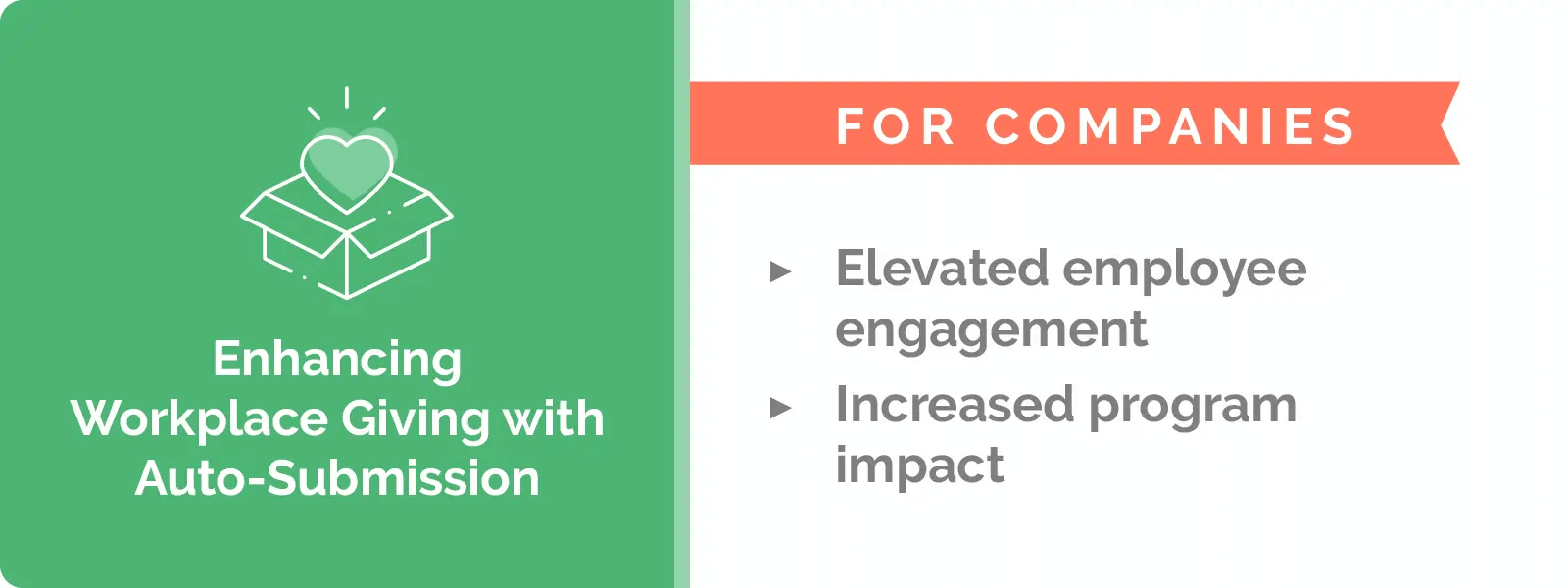

To encourage employees to participate in your program, invest in CSR software with auto-submission capabilities. This will connect your company’s information and matching gift request form to matching gift databases, allowing employees to automatically submit a match request upon making a donation.

As a result, your company will see the following benefits:

- Elevated employee engagement: Employees will be more engaged when they know your company values them—and the causes they value. Automating matching gift requests demonstrates your company’s eagerness to give and support the causes your employees care about.

- Increased program impact: Auto-submission streamlines the management of your company’s corporate giving programs. Plus, you’ll make it easier for employees to give and ultimately increase your company’s social impact.

Add to the impact of your matching gift program by further building out your CSR initiatives. For example, you might launch a corporate volunteer program in which your team can volunteer for nonprofits together or a volunteer grant to donate monetarily in response to their individual volunteer hours.

eCards

Whether you’re celebrating an employee’s birthday, wishing a customer a happy holiday season, or thanking a team leader for their hard work, thank-you messages can be simple yet meaningful gifts.

eCard software allows you to create customizable, digital greeting cards for any occasion, meaning your company can develop an arsenal of greeting cards for birthdays, work anniversaries, celebrating accomplishments, or any other situation warranting a gift.

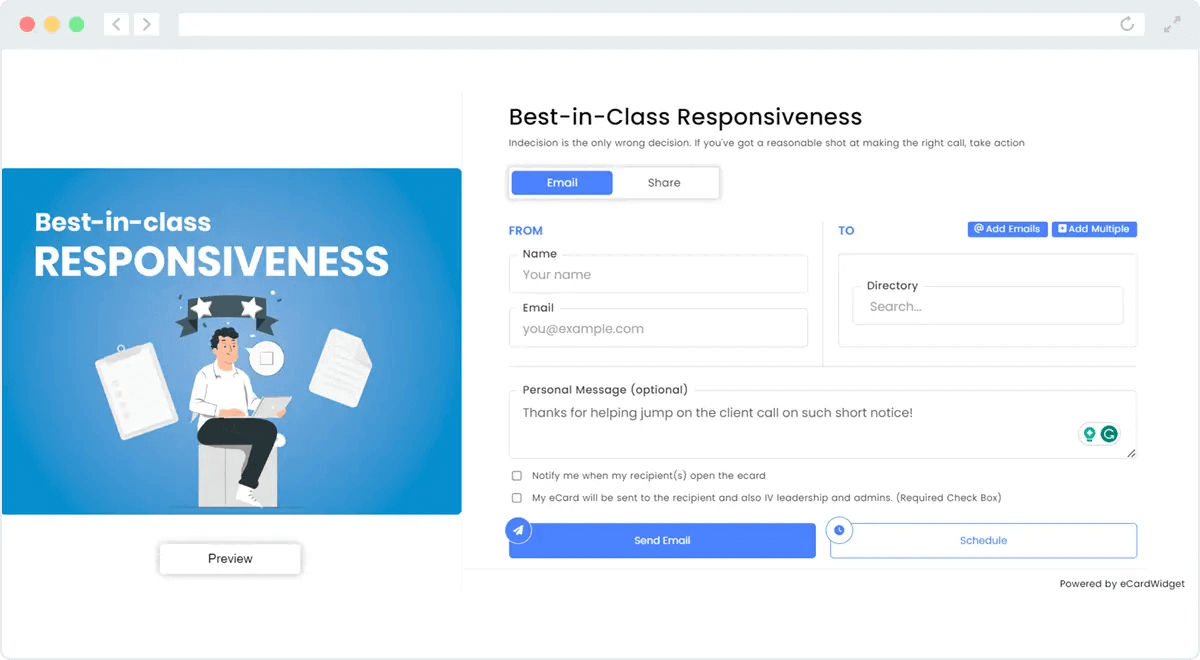

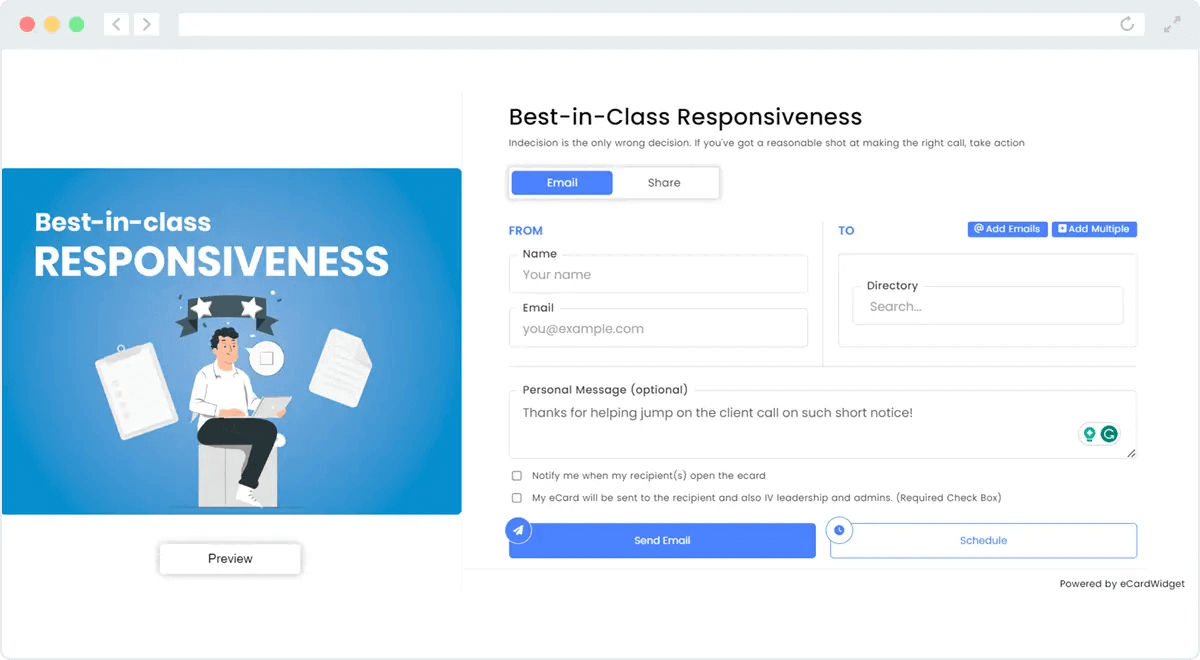

For example, let’s say you want to recognize an employee for going above and beyond in their urgency and responsiveness. Here’s how you could create an eCard to thank them:

- Design the eCard: Create a design for the eCard that calls out the purpose of the message. In this example, you could title the card, “Best-in-class responsiveness” to thank an employee for prompt communication.

- Add a personal message: Personalize the card with a message so the recipient knows exactly what they did to receive a card and why their actions mattered. For example, you might write, “Thanks for helping jump on the client call on such short notice!”

- Opt-in to notifications: eCard software can notify you when the recipient opens their eCard, allowing you to track how and when employees engage with your appreciation messages.

With these features, you’ll be able to send unique eCards to employees and clients alike. Plus, by making the tool available to your team, you’ll encourage your staff to send eCards to each other and recognize their peers.

Tangible gifts

While any tangible gifts you give will be unique to the occasion and the recipient, here are a few ideas to kickstart your shopping:

- Gift baskets

- Wellness boxes

- Personalized stationery

- Sample products from your business

Tangible gifts are tricky to navigate since they require a careful balance between being personally meaningful and professional. Be sure to outline any relevant requirements for choosing tangible gifts in your corporate gift-giving laws to provide clear guidelines for choosing these gifts.

Tribute gifts

Aside from matching employees’ donations, your business can also give on their behalf to the causes they care about! For example, if you know that an employee volunteers at a local animal shelter, consider donating to that shelter on their behalf as an appreciation gift.

Additional Resources for Creating Corporate Gift-Giving Laws

Corporate gift-giving laws are unique to the organization that creates them, which is why your policy should foremost address your organization’s needs. For example, smaller, close-knit teams might have more flexibility while larger companies will need strict guidelines to ensure gift-giving is fair.

Consider where your company aims to be in the future and leave room in your policies to adapt to these changes. For example, do you plan to double your staff? Will you serve a new client base? As you consider your company’s growth and the policies that you’ll need in place to account for it, look over the following resources for more tips: