Earlier this year I constantly heard CNBC pundits say, “The Federal Reserve has never gotten it right before, so why should we think they are right now?” When discussing the Fed’s rate hiking agenda, what I rarely heard from the talking heads on TV were references to current economic data that truly supported this claim.

Instead, they seemed governed by stories and their emotions.

Near the end of September, I wrote about how inflation data supported the Fed’s actions, and why I thought they deserved some praise for navigating us towards what increasingly appears to be a soft-landing. Almost seven weeks later the markets finally seem ready to believe it, thanks to the data in the most recent CPI inflation report that was released Tuesday, 11/14/23.

What was in it that made almost everyone feel so good? Let’s look at it from the same perspective I laid out previously.

The Difference Between Headline & Core Inflation

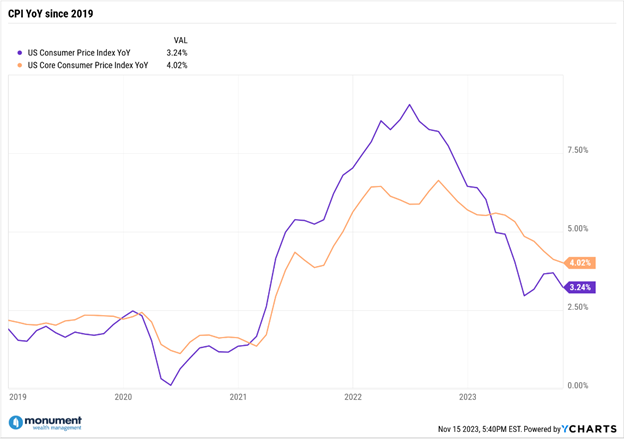

Starting at a 10,000-foot view: inflation eased in October. Headline year-over-year inflation came in at 3.24% in the most recent CPI report while Core CPI inflation registered at 4.02%. As a reminder, Core inflation strips out the sometimes-volatile effects of the Food and Energy components. That leaves Housing (where you live), Core Goods (products you buy), and Core Services (stuff you do) as the elements of Core Inflation.

Both the Headline & Core inflation measures in October’s report were slightly below the market’s consensus estimates and below the previous month’s readings. Lower than expected inflation sent both stock & bond prices soaring on the day since the markets interpreted this piece of data as a signal for the end of rate hikes. While it’s too early to know for sure, I think they may be onto something.

Why? Because, as we’ve been saying for a while, the underlying data continues to support declines in inflation.

We’re Finally Seeing Declines in Housing Inflation – But Not from Obvious Places

In this inflationary environment, I’ve focused on the components of Core inflation since they are viewed as sticky, or longer-term inflation metrics. Back in August, our co-Founder Dave wrote about how the official data collected for Housing, the largest component of Core CPI, lags what’s actually happening in the real economy.

It’s taken some time, but we seem to be experiencing some of the declines in Housing inflation that I’ve written about before. However, it isn’t coming from the obvious places. Thankfully, it’s not coming from major declines in home or rent prices like many expected. In my opinion, a collapse in home prices or rent levels could be a seriously bad economic event that would be extremely painful for everyone.

Instead, the relief we are experiencing is thanks to declines in Lodging Away from Home, which includes hotel and motel rates. In October, Lodging Away from Home fell -2.5% and has declined in four of the past five months.

The Pandemic shut down the globe and created pent-up demand especially for vacations. It’s no surprise that increased travel demand drove up Lodging Away from Home prices significantly, which pushed the official Housing inflation data higher. But now we’ve worked off some of that excess demand and are seeing lower hotel/motel room prices that are feeding into the official Housing inflation data and are helping Core CPI continue to come down.

The pandemic caused huge imbalances not only in travel, but also in the supply and demand for physical goods, which is another component of Core CPI. After high levels of Goods inflation in the recent years, most of that inflation seems to be behind us with retailers like Walmart’s CEO warning of possible deflation in the coming weeks and months.

These imbalances appear to be a primary driver of what caused the spikes in inflation across the board. The economy needs time to rebalance itself, or said differently, for the pig to pass through the python. As we approach the end of 2023, it’s great to see some of the excess demand begin to wane, and we will hopefully see some stabilization back to pre-pandemic levels.

You Don’t Need Courage, You Just Need Data.

The path to a soft-landing was littered with landmines and pitfalls. It was never a sure thing and wasn’t always the consensus. Some might say it took bravery to believe in a soft-landing, but if you looked at the underlying data for each of the components in Core CPI inflation, you didn’t need much courage. Just belief in the data.

As an investor, if you can dig a bit deeper into the inflation reports, you might have seen the soft-landing path that was being laid out in the data right in front of you. I’ll say it again today: The Fed deserves some praise for what they’ve accomplished so far, and its thanks in part to their execution of a long-term plan that is based on actual inflation data.

In all financial matters, be like the Fed. Don’t get emotional—take courage in cold, hard, and (sometimes boring) data. And if the data feels too overwhelming, find a Wealth Manager who can help you make sense of the endless financial jargon!