What You Need to Know

- Federal Reserve Chair Jeome Powell’s lack of urgency to adjust rates echoes that of his colleagues.

- Austan Goolsbee, head of the Chicago Fed, said progress on inflation has stalled out.

- Some policymakers are increasingly coming around to the idea that the post-pandemic economy is fundamentally different from the years leading up to it.

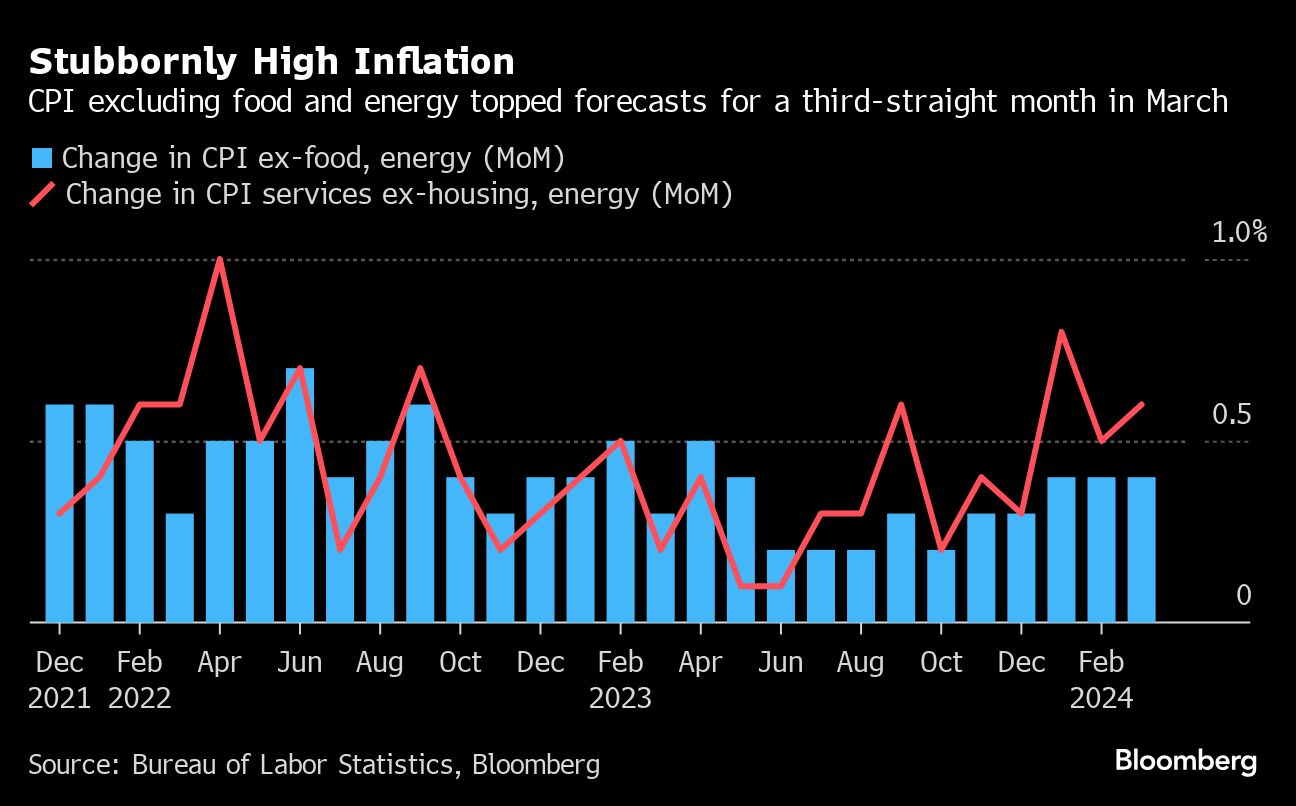

A string of disappointing inflation data has forced the Federal Reserve to reset the clock on its first interest-rate cut and re-evaluate the trajectory of price growth.

Chair Jerome Powell cemented that message this week when he said it’s likely going to take “longer than expected” to gain the confidence needed to lower rates, dashing hopes for more than two cuts in 2024. Some worry there may be none at all.

“This is confirmation that the Fed’s willing to wait it out,” said Diane Swonk, chief economist at KPMG LLP. “There’s concern of how little it took to stimulate the economy, that there’s still a lot of demand.”

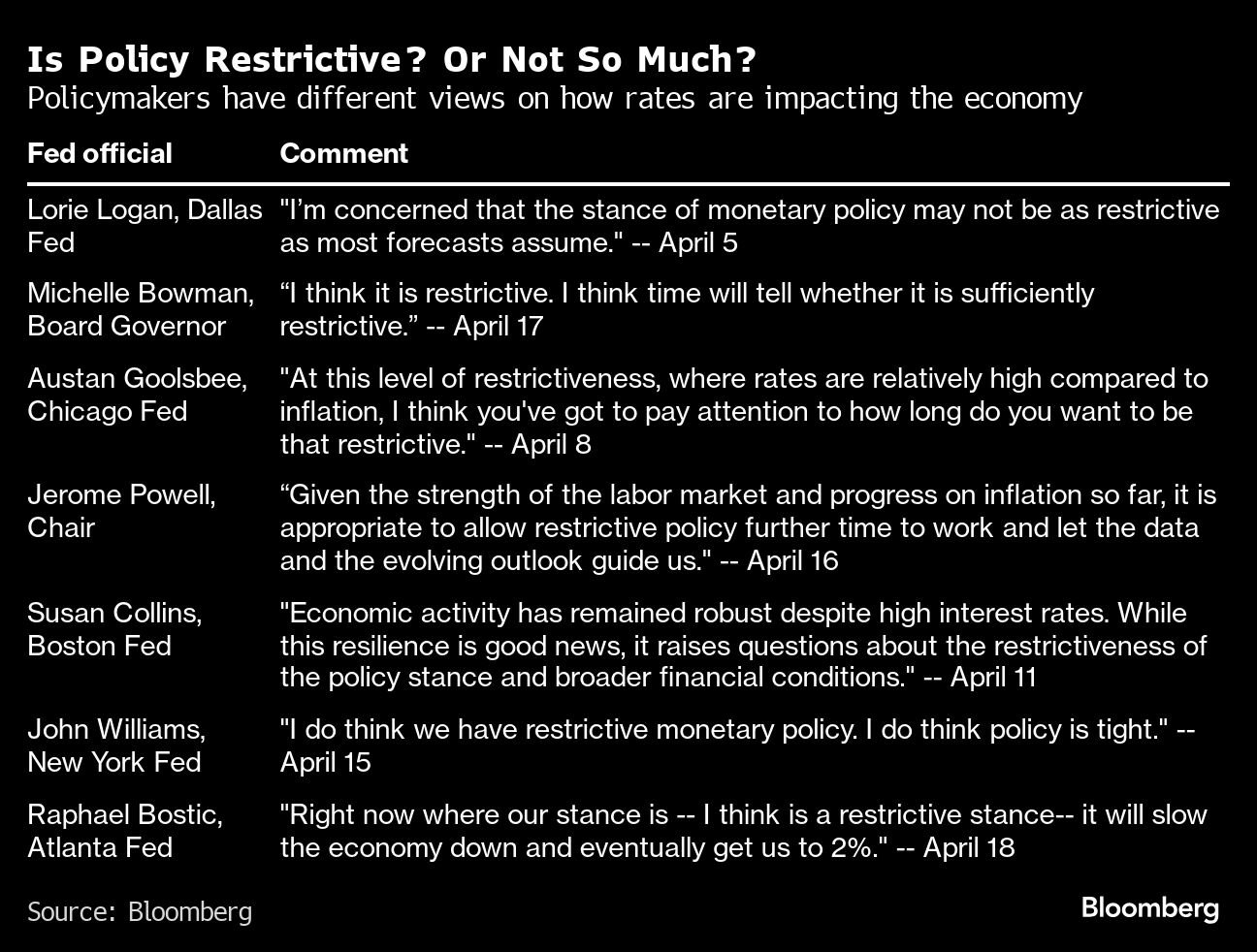

Powell’s lack of urgency to adjust rates echoes that of his colleagues. But the enduring strength of the economy and labor market, alongside a market rally at the start of the year, has also reignited a debate about just how restrictive monetary policy is.

Fed officials are increasingly voicing concern high borrowing costs may not be doing enough work to rein in demand, increasing anxiety among investors and analysts that the central bank may need to raise rates further.

Most policymakers have made clear they expect interest rates are at their peak, but some Fed officials have expressed an openness to the idea should it be necessary to tame price growth.

New York Fed President John Williams, who describes current policy as restrictive, said Thursday that raising rates is not his baseline expectation. But he added it’s possible if the economic data warrant higher rates to reach the Fed’s inflation goal.

Boston Fed President Susan Collins cheered last year’s rapid disinflation in a recent speech, but expressed concern that without cooling demand, prices will continue to be pressured higher.

“This implies that demand will need to moderate for the Fed to achieve its price-stability goal,” Collins said in an April 11 speech. “So, while resilient activity is good news, it also raises questions about the extent to which the stance of monetary policy is actually restraining demand.”

Economists now expect two cuts this year, down from three forecast in March, according to the median estimate in a Bloomberg survey.

Much of the inflation progress seen last year can be attributed to improvements in the supply side of the economy: tangled-up supply chains finally unraveling and a huge influx of immigrants helping fill vacant jobs.

All the while, demand remained strong. In the second half of 2023, the economy grew at the fastest back-to-back pace in two years. And just last month, retail sales grew 0.7%, exceeding economists’ forecasts.

But because demand is the main channel through which monetary policy works, its persistence is fueling skepticism about how much policy is constraining the economy.

“If you don’t know how restrictive you are, you almost have to wait to see it,” said Sarah House, senior economist at Wells Fargo & Co. “Uncertainty around how restrictive policy is likely draws out the timeline of the current policy setting.”

Austan Goolsbee, president of the Chicago Fed, echoed that sentiment Friday, when he said progress on inflation had stalled out.

“Right now, it makes sense to wait and get more clarity before moving,” he said, adding that it’ll likely take longer to get inflation to the Fed’s 2% target than previously thought.